The price of Ethereum is approaching the $2,700 mark as the Wyckoff accumulation phase appears to be nearing its conclusion. Crypto analyst Incognito forecasts a potential rally in Ethereum’s price, projecting it could reach as high as $2,700 in the near future. This optimistic forecast arises in the context of ETH’s recent lackluster performance, as the altcoin’s market share has already declined to unprecedented lows.

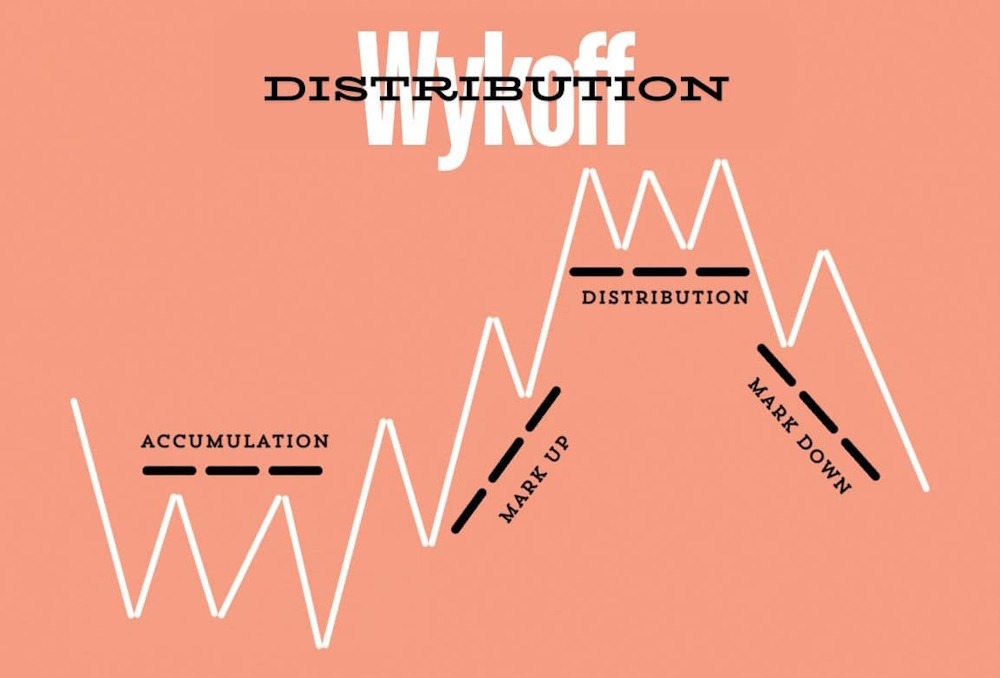

The price of Ethereum may experience an upward movement towards $2,700 as the Wyckoff accumulation phase approaches completion. In a recent analysis on TradingView, Incognito suggested that Ethereum’s price may be poised for a significant upward movement towards $2,700, as the Wyckoff accumulation phase appears to be nearing its conclusion. He noted that should support remain intact, Ethereum is likely to experience a breakout from the falling wedge pattern. The analyst’s accompanying chart indicates that $2,499 serves as the primary target for the falling wedge pattern, whereas $2,700 represents a secondary target that Ethereum may achieve during this breakout phase. Nonetheless, Incognito cautioned that this scenario could represent a significant pitfall designed to eliminate sellers, thus advising market participants to consider realizing profits. Currently, there is a potential for Ethereum’s price to experience an upward breakout, particularly as Bitcoin makes efforts to regain the $90,000 threshold.

The price of Ethereum is poised to achieve new local peaks, contingent upon Bitcoin’s ability to maintain its current bullish trajectory, reflecting their positive correlation. In a recent X post, crypto analyst Ali Martinez indicated that the current week holds significant potential for ETH, as the TD Sequential has just signaled a buy, suggesting a possible change in momentum. Martinez additionally suggested the potential for Ethereum’s price to initiate a new bull rally. For this scenario to materialize, he indicated that ETH must surpass the supply barrier at $2,330. The prominent altcoin may encounter considerable selling pressure within that range, given that 12.62 million addresses acquired 68.63 million ETH in that vicinity.

Ethereum may have reached its lowest point. A recent post by crypto analyst Titan of Crypto indicated that the price of Ethereum has likely reached its lowest point or is in the process of doing so. The leading altcoin is demonstrating upward movement within a substantial ascending channel on the macro chart. The accompanying chart indicated that ETH has the potential to rally to a peak of $4,200 in the wake of this bullish reversal.

Crypto analyst Hardy expressed a comparable viewpoint, indicating that the Ethereum price may have already hit its lowest point. He observed that the weekly candle close for ETH exhibited bullish characteristics, serving as a favorable signal for a possible reversal at the critical support level near its present price. The accompanying chart indicated that Ethereum has the potential to ascend to a peak of $4,300 in light of this bullish reversal.

The resurgence of Ethereum’s price above the $4,000 threshold may set the stage for a potential ascent towards a new all-time high. Crypto analyst Crypto Patel forecasts that Ethereum may attain a valuation ranging from $6,000 to $8,000 by year-end. As of the current moment, Ethereum is priced at approximately $1,639, reflecting an increase of nearly 2% over the past 24 hours, based on information sourced from CoinMarketCap.